** Discussion on “base effect” seems practically meaningless.

** Exiting QE can not drag down alone the flying inflation and interest rate will have to be quickly raised to offset increasing profit caused by sales price hike.

** The required rise in interest rate may be even higher if sales volume goes up with price hike.

What actually matters is not "base time" but the entire accumulated inflation, as indicated below by parameter P% in equation 2, since the latest rise in corporate borrowing cost.

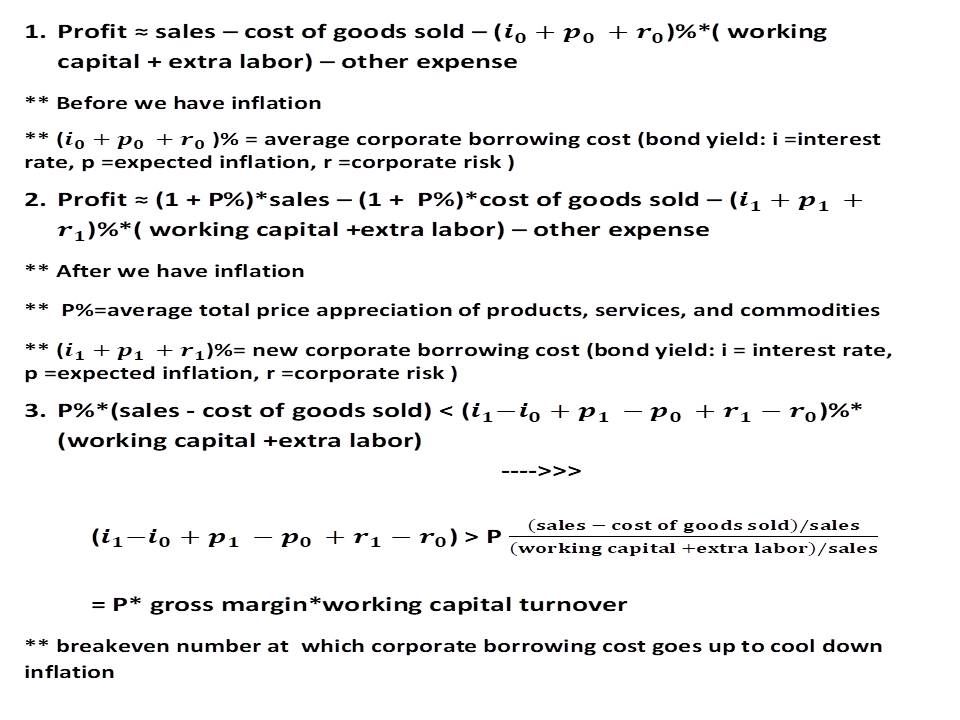

Monetary policy targets at borrowing cost (bond yield i, p, and r in equation 1 and 2) to curb inflation by offsetting the increased profit resulted from an effective inflation (P%).

Without QE, the yield will return to its market rate, as indicated in equation 3, as r1 goes up from r0 and p1 up from p0.

However, exiting QE can not push up bond yield high enough to fully offset the increased profit. Fed still needs to increase interest rate (from i0 to i1), which, as indicated by in equation 3, will be as high as 50% of P (assume that gross margin*working capital turnover = 1.5 - 2, P=p1, and r1=r0).