-- Dow may plummet by 10%-20% with an inflation of 2-4%

-- Washington can't bear increasing interest payment of its debts

VS

-- Economy will head into an effective inflation cycle driven by inflating wage and price

-- A larger impact on Dow later when hastily raising rate above tightening QE

-- A smaller distress for Washington in paying its interest of debts

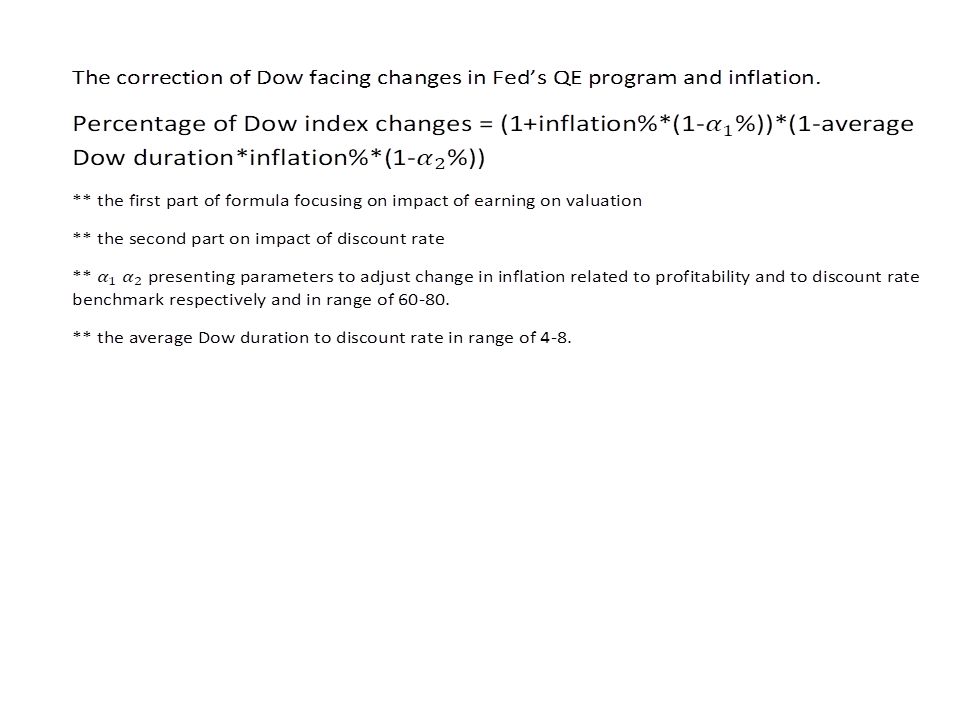

As indicated by our formula below, when Fed quits QE, Dow will fall below 31,000 with an inflation of 2% or below 29,000 with an inflation of 4%.

Investors can lend money to Washington for paying off its treasuries’ principles to them but not for paying the interest to them. Washington has no budget now for increasing interest payment resulted from quitting QE.

The current inflation is not simply an issue of supply or speculation. With more QE it is very possible for US economy to be over-heated as a result of self-driving increase in labor wages and size, which will later require a rise in interest rate and thus may cause larger correction of Dow. However, because of economy growth by then the distress of increasing interest payment will be likely to be lifted.

Therefore, it is not hard to guess what Fed will do, who is near the Wall St but actually on Main St.