-- Different industrial structure leads uneven distribution, on the global industrial value chain, of price-driven corporate earning #growth .

-- Different #money supply determines allocation of money and their required returns.

-- The Key for #china is its industrial upgrading and Fed tapering is for US.

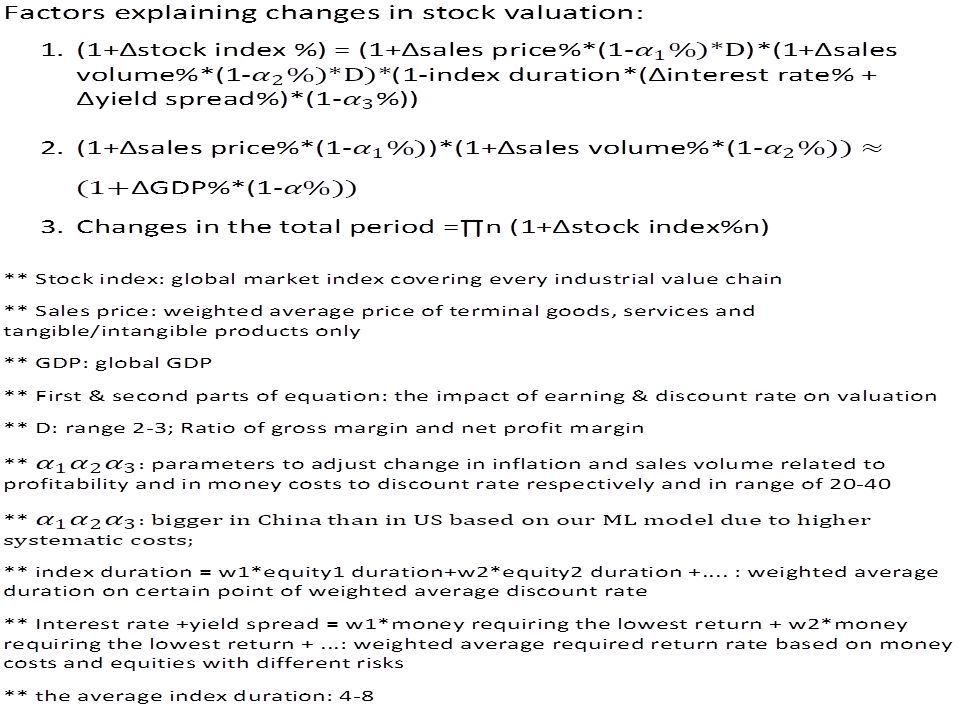

In equation 1& 2 , a global index rises either with industrial earning growth, measured by product of price inflation in terminal product &service on industrial value chains and their volume increase, or with discount rate decrease, calculated by the required returns of the cheapest new capital.

As to a country, US companies focusing domestic service can better contain price-driven industrial earning growth than China companies located on terminal end of value chain and without price negotiation power. US index is thus more consistent with industry/GDP.

In equation 1¬es, the discount rate decreases when new capital with lower costs and thus narrower spread replaces existing capital. With base money supply, the cheap capital in US becomes available for guys to buy their own or others’ equities. Under more M2 supply, the cheap money in China can go into #housing #market but not equities.