-- It depends on how consumers spend their personal savings piled up during the pandemic

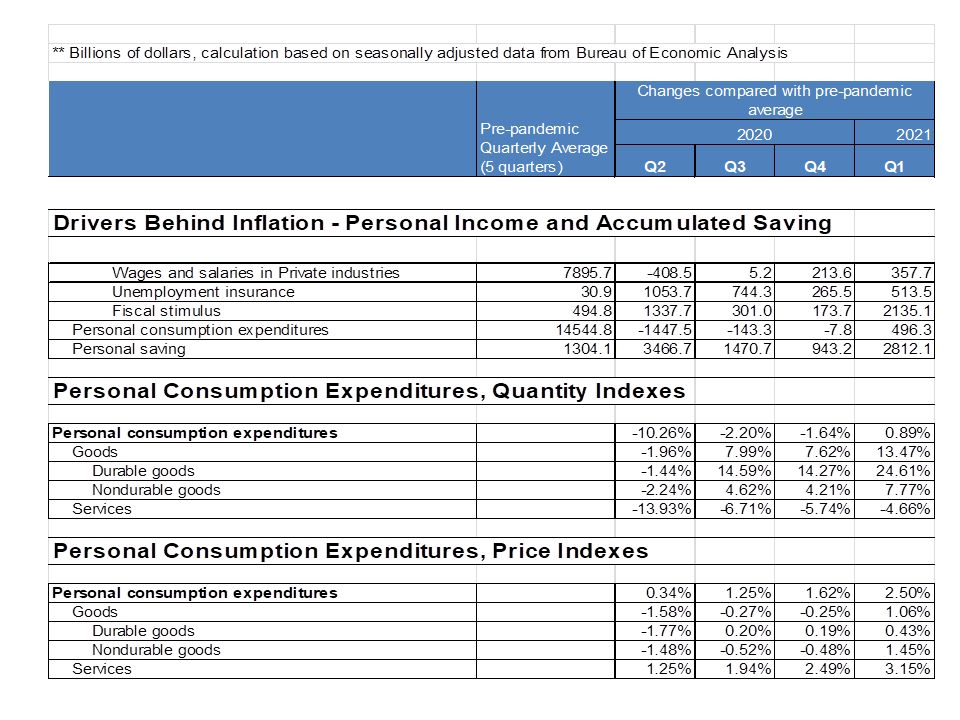

Personal consumer expenditures price index (BEA) increased by about 3.5%(annualized) in Q1 2021 compared with Q4 2020. As we see in chart below, the demand is lifting price and the major drivers behind demand have so far been the money from unemployment insurance and stimulus checks.

Therefore, it is normal for a concern to be raised that the steam will be removed when the generous unemployment insurance expires in September and there are no more checks coming.

The inflation is to keep staying higher (4%+ PCE index) in Q2 and Q3 2021 as the direct impact of stimulus stays and consumer service recovers. What will happen next will depend on the approximate $8 trillion personal saving accumulated beyond conventional saving levels, ¾ of which will go to consumption.

Our model shows, for example, if consumers spend those money in two years, generating $0.8T extra expenditure quarterly, inflation may go down temporarily in Q4 2021 and then jump back on previous track ( 2%+ annually) as full employment causes labor shortage and wages to soar. However, if consumers spend it faster, the acceleration of inflation will be much bigger.