-- Dow will face a direct correction of about 7%, 55% of which is an exclusive result of valuation and 45% of which is attributable to increase in corporate interest expense.

-- The market will be focusing on how the exact inflation will diverge from current market expectation and how sales volume will be impacted by economic and social activities.

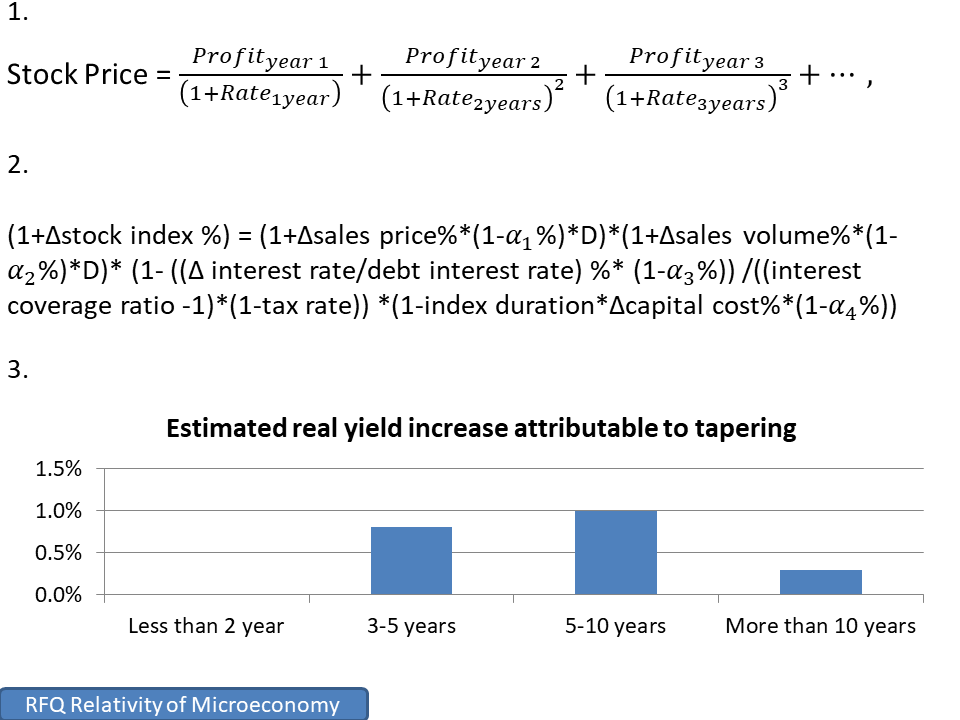

As indicated from our last analysis, weighted-average interest rates of US corporate debts for new investment, which will go consistent with treasuries yields, is expected to increase by about 55 bps if the Fed stops buying treasuries today. The average profit in new investment, according to our model, will thus go down by about 8.5% from current level due to higher interest burden.

Our model based on equation 1 further indicates that there will be about 3.8% decrease in Dow index generally attributable to increase in required returns of stocks as a result of increased treasury yields driving up capital costs for investments with different maturities correspondingly.

The model also suggests another 3.3% drop in the Dow index caused by an accelerating decrease in corporate profit projection as a result of increased treasury yields driving up debt costs of existing investment as they are being renewed with higher interest rates.

Considering the fact that tapering’s impact on the stock market may be more than just immediate changes in stock investment costs and corporate debt costs, we based our analysis on an assumption that there is nothing to be significantly changing the market’s long-term expectation on money liquidity or inflation.

However, without the assumption above, our model indicates that the volatility of the Dow index may be reaching as much as +/- 20% given unexpected changes in sales price or sales volume as compared with their current expectations of the market.

For example, we think that the current inflation is not mainly an issue of supply or base effect but being continuously driven by effective demands and wages increase. The stock market benefits from a sales price hike. However, it will be really hard to maintain if the economy is overheated.

#economy #stockmarket