It is true that

-- Money supply growth brings more benefits to economy than troubles

-- The part of M2 created by bank’s lending and thus collateralized by real wealth may periodically cause chaos but barely hurt the state credit

-- Base money is the root of state credit/currency crisis but it is still fixable as long as we have no nuclear war, planet bumping, or severe climate change that stop tax to be collected

However,

-- If only economic factors are being considered, there is a better equilibrium, between benefits and shocks brought by money supply, than what the Fed is pursuing

The principle of money supply should always be that being over is not worse than being short.

Credit plays all roles in transferring wealth to facilitating investment, which, together with labor and demand, drives economic growth. As the representation of wealth, money, when being created, must be linked to some certain real wealth so that the holders of money can redeem if needed.

Obviously, these designated wealth is better to be something existing, such as land, commodity, housing, net booking assets of a company, or terminal products, that people have an immediate demand for. High quality future cash flow, such as securities, may work as well sometimes.

Among M2 money supply, the part created by commercial banks, which may cause chaos when collateral’s value behind loans deviates, is usually not supposed to hurt the credit system because those money can always be traced back to some real wealth generally.

The base money, which does not need a specified real wealth as collateral any more in current system, is based on the assumption that central banks can always quickly acquire the needed collateral for those money, by providing high enough return and based on future cash flow from tax collection, as long as there is still extra real wealth in economy that is not being used as collaterals yet. That is why we say the total wealth(excluding M2) is the ceiling of M2 supply.

Theoretically, if holders of base money are confident in political and economic stability and can wait for the wealth to be accumulated in future, M2 can certainly be printed beyond the ceiling - the existing wealth.

However, the reality is that, as long as M2 supply gets faster than real wealth accumulation, no matter how far it is below the ceiling, holders of money will rush to core real wealth to redeem their money. Because those redemption is overly concentrated on land, housing, commodity, valuable companies, or terminal products, while there is still much more wealth available for being redeemed since M2 is still small compared with the total wealth, money seems to be devalued as presented in inflation of those wealth mentioned above.

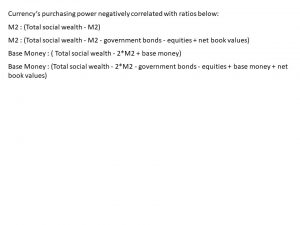

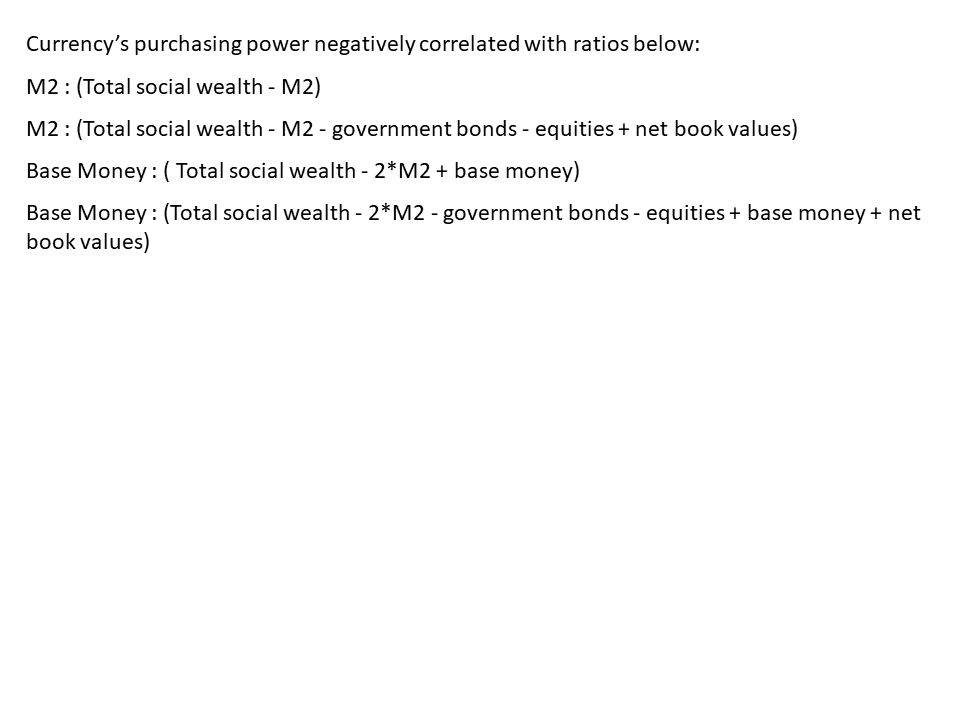

Simple formulas below to measure currency’s value.