** TIPS prices tell us CPI expectation.

** The expectations are from only a fraction of bonds investors.

** TIPS tend to overestimate the expected changes in CPI, but treasury bonds don't

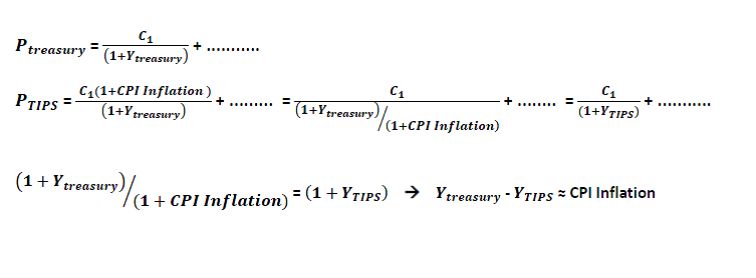

The bottom demonstration shows how the TIPS price imply an expectation of inflation.

The TIPS' yield (Ytips) is actually not financially explainable. However, as we can see in equation that just because it mathematically happens to be roughly equal to the subtraction of treasury bond's yield and the average inflation (CPI increase) expected by TIPS buyers, it is calculated based on the market price and explained as a yield with zero inflation until mature.

TIPS provides a direct clue of how people estimate inflation in the market. However, as a small fraction of treasury bonds, TIPS does apparently not represent a consensus of inflation expectation among all bond investors and thus not significantly influence pricing of assets.

In fact, what is determining in the market is always the treasury bonds. Since money in treasury has high liquidity and can go to risker places for higher return, the demanded extra compensation to increasing inflation, as reflected in treasury bonds prices, is less likely to be as aggressive as in TIPS' price.