Where is the Alpha of PE investment from?

I define the alpha of PE investment here is the extra return compared with the return when there is no significant change before exits as compared before acquisition. In another word, the benchmark is the return calculated given the constant cash flow and unchanged exit price.

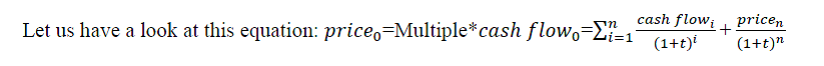

We can find that if the cash flow keeps constant and thus only a little time value is added into the selling price, the return during the whole holding period will be determined by its buying price or the multiple. I believe there is a power from demand and supply of the market that is helping determine the multiples, and the strong demands for investment opportunities, thanks to quantitative easing policy, and the routine overestimating of business of the sellers is shaping the big picture that it is basically impossible that the buyer is able to lower the multiple enough to gain excess return above the average.

Therefore, it is apparent that relying on outstanding negotiation skills for a lower buying price or for a higher selling price when exits cannot bring extra return to investor considering the risks that they are undertaking.

The expected extra return comes, based on my understanding of PE investment, only from numerator of the equation mentioned above, the increased cash flows after transaction. There are basically two ways to increase cash flows. Managing to increase revenue is apparently the most direct method. However, the increase in revenue is usually limited by the whole industry circumstance and also means increasing investments. I believe, based on the nature of PE and its life cycle, this is definitely not a preferable option. In fact, in my experience of reviewing companies which are usually small market size firms, I found there is a large room for many of those firms to generate more profits by simply optimizing business or operating structure in the circumstance of keeping their current products or services and marketing strategy unchanged. Low efficient management and operation of target firm, in my opinion, is what makes extra return of PE investment possible compared with other type of investment because it takes full use of uniqueness of PE investment-100% controlling of target company. The value created comes from the sensitivity of PE analysts to business models and expense structure and as well the ability to find high efficient one. And our database provides a perfect tool for PE investors to identify low efficiency of their target firms by comparing it with its peers.